Rebalancing risks: inflation vs growth

Jorge Silveira Botelho | BBVA Asset Managment

Head of the BBVA Asset Management business unit in Portugal

With more than 33 years' experience in asset management and capital markets, Jorge Silveira Botelho is responsible for promoting and managing the BBVA Group's asset management business in Portugal.

September 2024 by Jorge Silveira Botelho

When the US Federal Reserve decides to reverse its monetary policy, this move is commonly referred to as a “Fed Pivot”. This name is particularly important because it focuses on balancing the risks between inflation and growth.

In Europe, the European Central Bank's sole objective in conducting monetary policy is to control inflation, while in the US the Fed has a dual mandate, i.e. it aims to ensure both inflation control and full employment. It seems clear that price deceleration is an ongoing process in the global economy. But the most important thing is that lower inflation necessarily means an increase in consumer confidence. Currently, this price slowdown obviously extends to the American economy, where signs of slowdown and falling prices are evident.

When we look at the inflation figures for August in the US, we can easily deduce that almost 94% of the 3.2% underlying inflation can be explained by the contribution of just two sub-components of the consumer price index: rents (72%) and car insurance (22%).

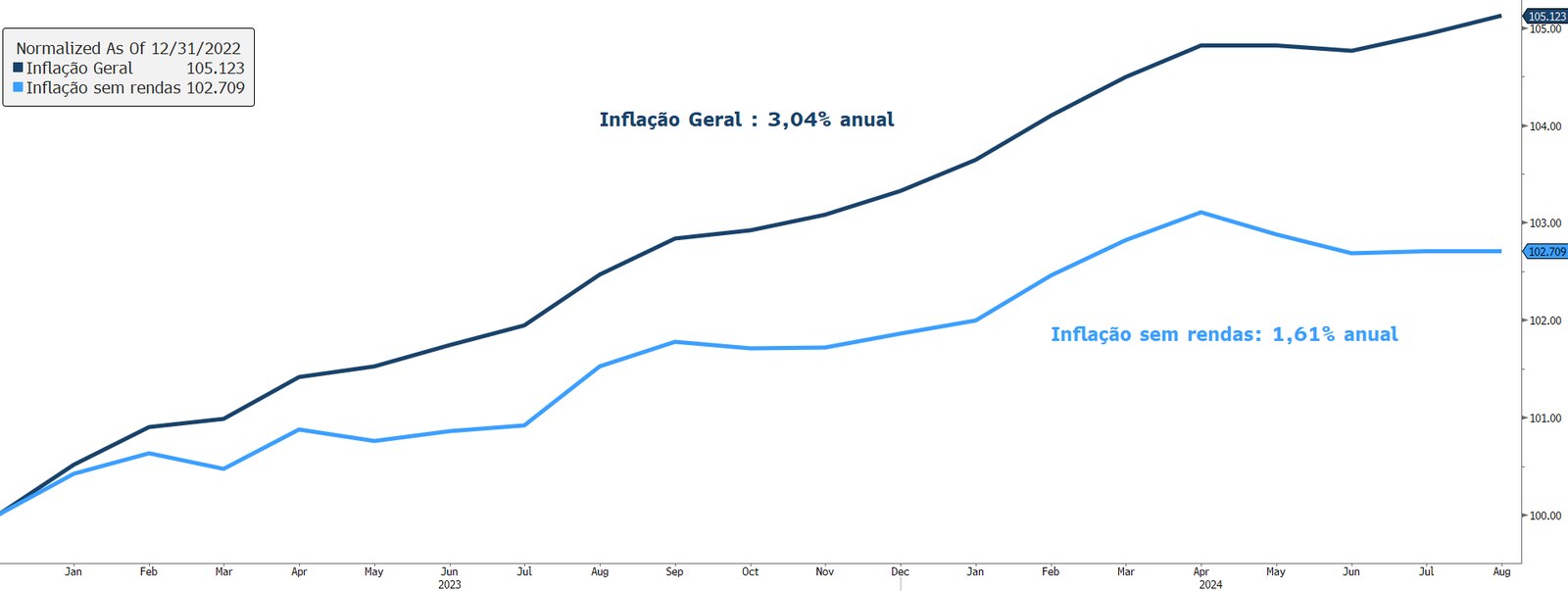

In fact, since the end of 2022, if we subtract the rent component from general inflation, it has been 1.61% in annual terms, while if we include them again in the calculation, general inflation has been 3.04% in annual terms since then. In addition, the effect on rents is delayed, since the calculation methodology does not reflect current conditions, where a significant slowdown in rents is already visible...

If we consider that almost two thirds of Americans own their own home, the value of rents only really affects one third of the population directly, because for the rest it is just a measure of the increase in the cost of living and the evaluation of the opportunity cost of owning a home.

In this context, the relevant theme that the US Federal Reserve has recently taken on is that the disinflationary process is unfolding correctly, which shows additional confidence that the risks are much more balanced between growth and inflation.

In practice, what all this means is that we're going to see more interest rate cuts in 2024, in 2025 and most likely these will continue until 2026.

As such, in this this disinflationary process investors should intuit that this greater visibility of monetary policy should provide greater visibility of the evolution of the current economic cycle.